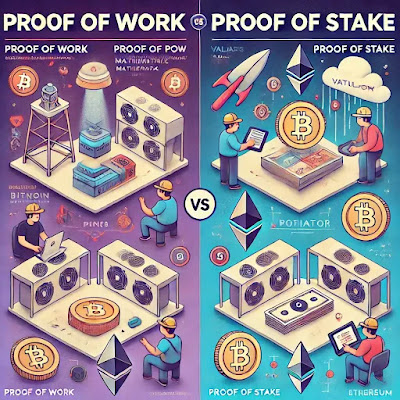

Proof of Work vs. Proof of Stake: A Beginner's Guide to How Cryptocurrencies Secure Their Networks

If you’ve ever wondered how cryptocurrencies like Bitcoin and Ethereum work, you’ve probably heard of terms like Proof of Work (PoW) and Proof of Stake (PoS). But what do these terms actually mean, and why are they so important?

What is Proof of Work (PoW)?

Let’s start with Proof of Work, or PoW, the mechanism behind Bitcoin and several other cryptocurrencies. If you’ve heard of Bitcoin, you’ve probably heard about PoW too. So, let’s break it down.

The Basics of Proof of Work

At its core, Proof of Work is a system that requires participants (called miners) to solve complex mathematical puzzles in order to add new blocks of transactions to the blockchain. When they solve the puzzle, they’re rewarded with cryptocurrency, like Bitcoin.

Imagine you’re in a race. Everyone’s trying to solve a tricky puzzle (which requires a lot of computing power), and the first one to finish wins a prize. That’s what PoW is like – a competitive race to find the solution.

How Does Proof of Work Actually Work?

Let’s dive a bit deeper:

- Miners Compete to Solve a Puzzle: Miners use powerful computers (often with specialized hardware like ASICs) to try and solve complex math problems. These problems are extremely difficult but can be solved in a predictable amount of time.

- Finding the Solution: Solving the puzzle involves finding a specific hash (a unique string of numbers and letters) that matches certain criteria. It’s like trying to guess a lock combination, but the lock is ridiculously complex and the only way to open it is by randomly trying different combinations until you get it right.

- Adding the Block to the Blockchain: Once a miner solves the problem, they get to add a new block of transactions to the blockchain (which is just a digital ledger of all Bitcoin transactions). As a reward, they receive Bitcoin. Cha-ching 🎉

Example: Mining Bitcoin with PoW

- Miners use their computers to compete and solve a cryptographic puzzle.

- The first miner to solve the puzzle adds the transaction block to the Bitcoin blockchain.

- The miner receives a block reward of 6.25 BTC (this reward gets halved approximately every four years).

- This process is how new Bitcoin is created, and it helps secure the network by ensuring that only valid transactions are added to the blockchain.

What is Proof of Stake (PoS)?

Now that we understand PoW, let’s look at Proof of Stake (PoS), the mechanism used by cryptocurrencies like Ethereum (before it switched to PoS) and Cardano. PoS is a newer alternative to PoW, and while it works differently, it has some pretty cool advantages.

The Basics of Proof of Stake

In Proof of Stake, instead of solving puzzles, validators are chosen to add new blocks to the blockchain based on the amount of cryptocurrency they’re willing to “stake” (lock up as collateral). The more cryptocurrency you stake, the higher your chances of being chosen to validate the next block. Think of it as a lottery where the more tickets you have, the better your chances of winning.

How Does Proof of Stake Work?

- Staking Cryptocurrency: Validators lock up a certain amount of cryptocurrency in the network as a stake. It’s like you’re putting your money in a security deposit box and saying, “I’ll keep this here, and in return, I’ll be allowed to help secure the network.”

- Validator Selection: Instead of solving math problems like PoW, PoS chooses validators based on their stake and some additional factors (like how long they’ve been staking). It’s like a digital lottery where the more you stake, the more likely you are to get picked.

- Validating Transactions: Once selected, the validator checks a batch of transactions to make sure they’re legit. If everything checks out, they add the block to the blockchain.

- Earning Rewards: In return for validating the block, the validator earns transaction fees and possibly new cryptocurrency. If they try to cheat the system, they risk losing their stake. Yikes!

Example: Ethereum's Transition to PoS

- Before Ethereum transitioned to PoS in 2022, it used PoW (just like Bitcoin). But now, Ethereum validators lock up their ETH as a stake, and they are randomly selected to validate the next block.

- In PoS, you don’t need expensive mining rigs or to solve complex puzzles. You just need to stake your coins.

- The more ETH you stake, the more likely you are to be chosen as a validator and earn rewards.

Key Differences Between PoW and PoS

| Feature | Proof of Work (PoW) | Proof of Stake (PoS) |

|---|---|---|

| Energy Consumption | High (due to mining hardware) | Low (no mining hardware needed) |

| Security | Secure, but costly to attack | Secure, but relies on staked funds |

| Hardware Requirements | Expensive mining rigs (ASICs) | No hardware, just need cryptocurrency to stake |

| Centralization Risk | More centralization due to expensive mining equipment | Less centralization, more inclusive for regular users |

| Environmental Impact | High (requires lots of energy) | Low (no intense computations) |

Conclusion: PoW vs. PoS—Which One Wins?

Both Proof of Work and Proof of Stake are key mechanisms for securing blockchain networks, but they do so in very different ways. PoW is like a competitive race, requiring miners to solve tough puzzles, while PoS is more like a digital lottery, where validators are chosen based on how much cryptocurrency they’ve staked.

In the end, PoW is perfect for ensuring high security and decentralization, while PoS is ideal for energy efficiency and inclusivity. Whether you're mining Bitcoin with PoW or staking Ethereum with PoS, both systems help make the world of cryptocurrency possible.